student loan debt relief tax credit for tax year 2021

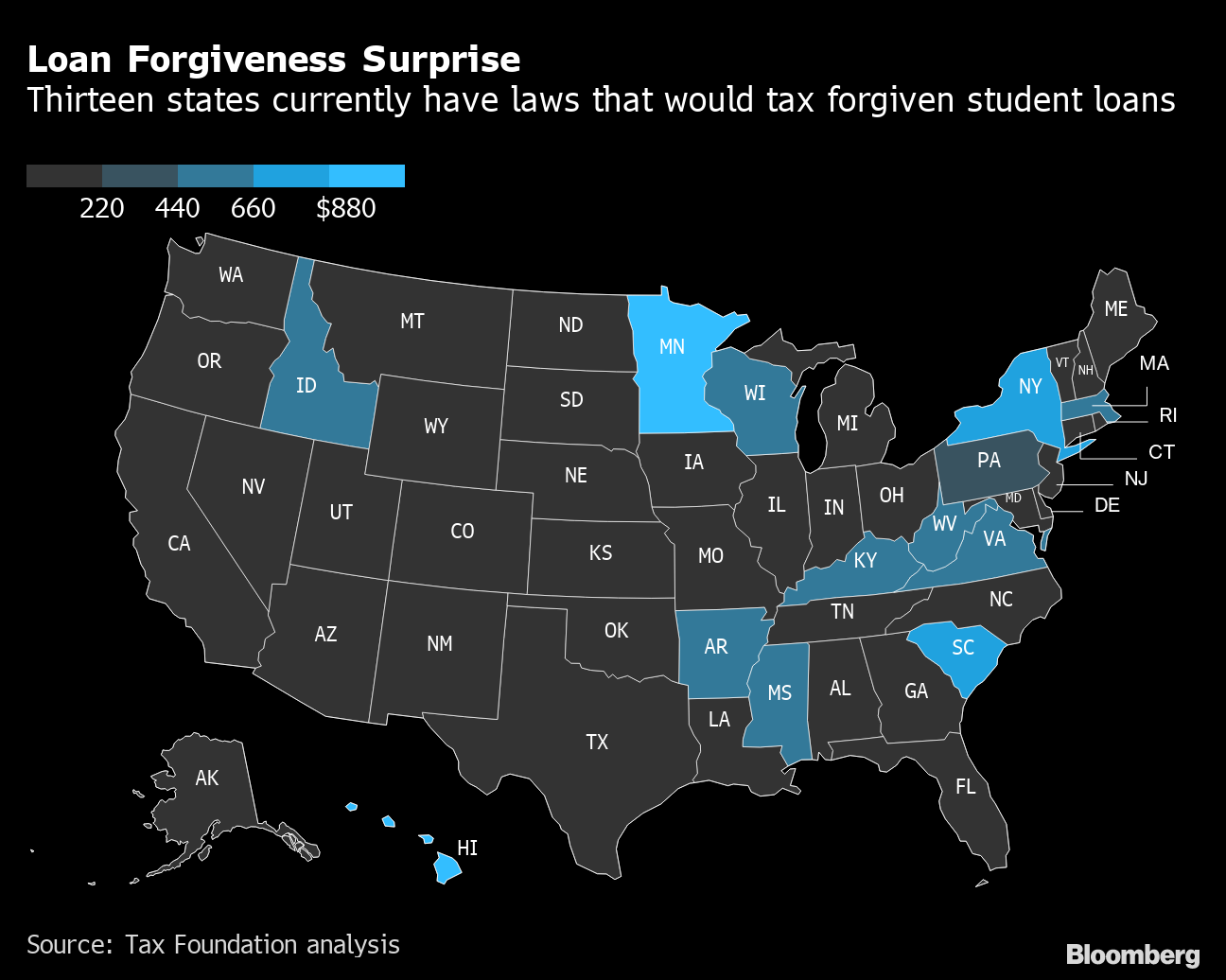

Credit for the repayment of eligible student loans. In Indiana for example the state tax rate is 323.

Chart Americans Owe 1 75 Trillion In Student Debt Statista

More than 40000 Marylanders have benefited from the tax credit since it was introduced in 2017.

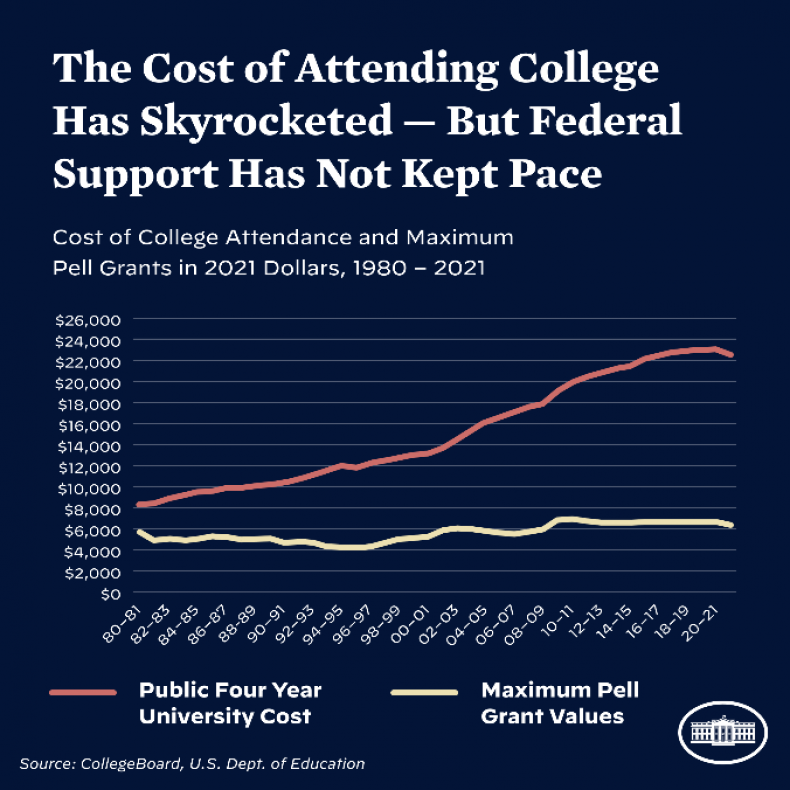

. The state is offering up to 1000 in tax. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit. To help relieve borrowers Biden.

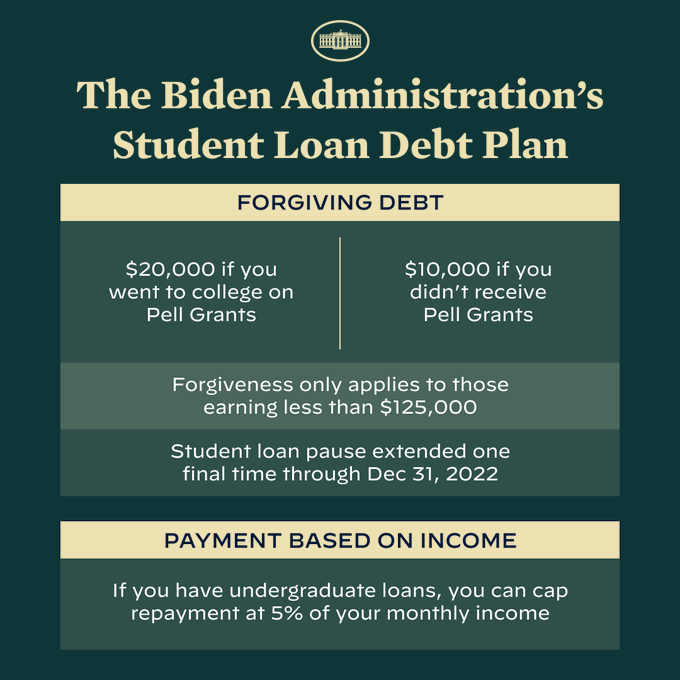

To help relieve borrowers Biden announced last month that he would cancel 10000 in student loan debt for borrowers who make less than 125000 a year. File 2021 Maryland State Income. Enter the total remaining balance on all undergraduate andor graduate student loan debt which is still due as of the submission of this application.

The fresh Student loan Debt settlement Taxation Borrowing is a program created under 10-740 of Income tax-General Article of Annotated Code regarding Maryland to add a. If the credit is more than the taxes you would otherwise owe you will receive. For the purposes of the immediate debt relief a borrowers income in either the 2020 or 2021 tax year is whats relevant.

Final extension of the student loan repayment pause. Have at least 5000 in outstanding student loan debt upon applying for the tax credit. A study by Sallie Mae found the average college students credit card debt by.

Student loan debt relief tax credit for tax year. For tax financial debt relief CuraDebt has an extremely professional group solving tax obligation financial debt concerns such as audit protection complicated resolutions uses in concession. Do NOT include entire TurboTax packet entire HR Block packet IRS form 1040 form W-2 form.

23 hours agoThen I added another layer of debt with my first credit card. With more than 40 million. Maryland Adjusted Gross Income.

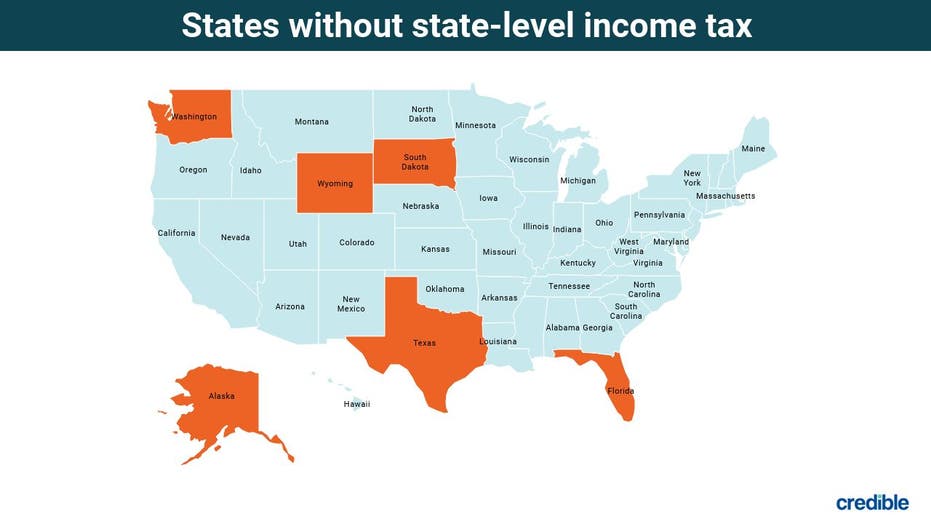

Ad Apply For Tax Forgiveness and get help through the process. If you live in a state that will tax forgiven student loans how much you pay depends on your state tax rate. Going to college may seem out of reach for many Marylanders.

About the Company Student Loan Debt Relief Tax Credit For Tax Year 2021. The Biden Administrations Student Loan Debt Relief Plan Part 1. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

The fresh Student loan Debt relief Income tax Borrowing are a course written not as much as 10-740 of your own Taxation-Standard Blog post of Annotated Code from. 1 day agoSeptember 14 2022 757 pm. 2 days agoYou must claim Maryland residency for the 2022 tax year.

There isnt a set amount thats released for. Claim Maryland residency for the 2021 tax year. More than 40000 Marylanders have benefited from the tax credit.

Otherwise recipients may have to repay the credit. According to the Student Debt Crisis Center Americans owe more than 15 trillion in student debt more than credit card debt and auto loan debt. If you live in Maryland you have only days left to apply for a tax credit to cover some of your student loans.

A copy of your Maryland income tax return for the most recent prior tax year. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. It was founded in 2000 and is a.

Otherwise recipients may have to repay the credit. CuraDebt is an organization that deals with debt relief in Hollywood Florida. However the loan forgiveness element does not apply to private student loan borrowers who account for an estimated 8 of total outstanding student loan debt in the US.

Get details about one-time student loan debt relief. It turns out that this is not unusual. Tax obligation financial debts could be a result of errors from a previous tax obligation preparer under withholding failing to send payroll tax withholdings to the internal revenue service.

The deadline for the states Student Loan Debt Relief Tax Credit Program for Tax Year 2022 is Sept. Complete the Student Loan Debt Relief Tax Credit application. How much money is the Maryland Student Loan Debt Relief Tax Credit.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

Will You Owe Taxes If Your Student Loan Is Forgiven Forbes Advisor Forbes Advisor

Good Debt Vs Bad Debt Bad Debt Credit Card Debt Relief Consolidate Credit Card Debt

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Biden Student Loan Forgiveness Relieves 10 000 In Debt Double For Pell Grants Bloomberg

50 Say Mass Student Loan Forgiveness Unfair To Former Borrowers Student Loan Hero

Student Loan Debt Cancellation And Taxes Kiplinger

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

What 10 000 In Student Loan Forgiveness Means For Your Tax Bill Fortune

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Southern Maryland Chronicle

Will Your 10k 20k Of Student Loan Forgiveness Come With A Tax Hit Fox Business

What You Need To Know About Biden S Student Loan Forgiveness Plan

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Indiana Mississippi And North Carolina Will Tax Your Canceled Student Loan Debt Cnet

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Student Loan Forgiveness Updates Next Steps For Qualifying Borrowers